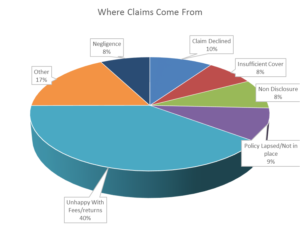

Your liability insurance, provided by NZI Liability/Lumley, has a long history. Let’s look at where TripleA liability claims and precautionary notifications have come from since 2005:

The pie chart above breaks down the 439 claims and notifications made to NZI Liability/Lumley by TripleA members since 2005. In the table:

- “Other” claims come from a range of causes such as Kiwisaver, defamation, claims for commission refunds, late returns, Privacy Act issues, taxation errors, among other causes.

- The data comes from several different systems over the years with different recording criteria. In reality, all claims are negligence based. The 8% shown as “Negligence” comes from a range of causes.

Perhaps just as relevant to where claims come from, is when they occurred. The following graph tracks notifications by year. As you can see the Global Financial Crisis initiated a large spike in claims. What is interesting the ‘spike’ started in 2006 returning to the normal background level of claims in 2010.

This shows the economic climate can be as much an instigator of claims as the issue itself. What may surprise is the spike in claims is not fully investment related. Mortgage advisers are at risk of claims when there are mortgagee sales. Similarly, income protection claims related to stress are always problematic, and increase in hard times.

Investment claims did not finish in 2008 with claims coming through as late as May 2013 from finance company investments. Similarly, we are still receiving claims related to the Christchurch earthquakes. These are for a range of issues such as insufficient cover and EQC funds not being transferred.

In general, no class of advice is safe from claims. Typically, we see:

- Investment advisers receiving claims because clients are unhappy with fees and/or returns.

- Mortgagee sales tend to initiate allegations the adviser never addressed their client’s ability to afford payments, even though it is the banks’ role to check affordability.

- Professional Indemnity claims against life and health advisers regularly come from declined death or income protection claims. What is particularly hard is these claims don’t generally come from the clients, family members who were generally not present during the sale process take up the cudgels.

- All advisers have ‘service level’ and administration type claims made against them which are part of the ‘Other’ claims in the pie chart.

ankara escort

çankaya escort

ankara escort

çankaya escort

escort ankara

çankaya escort

escort bayan çankaya

istanbul rus escort

eryaman escort

escort bayan ankara

ankara escort

kızılay escort

istanbul escort

ankara escort

ankara rus escort

escort çankaya

ankara escort bayan

istanbul rus Escort

atasehir Escort

beylikduzu Escort

Ankara Escort

malatya Escort

kuşadası Escort

gaziantep Escort

izmir Escort